You could work with a partner buy an owner occupied duplex with a down payment gift or ask the owner for seller financing with no money down.

Owner occupied multi family mortgage.

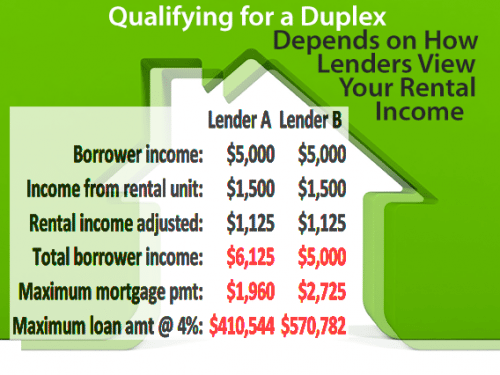

There tends to be a wider variation in loan terms for investment property mortgages which makes shopping multiple lenders more important.

Multifamily mortgages are available for buyers of duplexes as well as of three and four unit dwellings.

This could be as much as 25 for a multi family.

3 to 4 units require a 20 down payment.

The property is not occupied by the owner.

In many urban communities 2 to 4 unit housing is the key affordable housing inventory for primary residences.

Understanding the financing options that are available to investors is the first step in realizing the financial benefits of living in a unit of your multi family property.

A two to four unit residence that is owner occupied or a one to four unit.

Freddie mac home possible conventional loan programs allow 5 down payment on multi family property financing.

A classification used in mortgage origination risk based pricing and housing statistics for one to four unit investment properties.

Review current non owner occupied mortgage rates for october 2 2020.

While owner occupied multi family property may present new challenges for investors they also have the potential to take an investor s career to the next level.

The table below enables you to compare non owner occupied mortgage rates and fees for leading lenders in your area.

The main advantage of an fha.

Freddie mac home possible loan programs program allows as little as 5 for the down payment for 2 4 units with no income restrictions.

To be eligible for fha loans the investment property has to be owner occupied.

Buying a duplex or multi family home with 3 4 units gives you the advantage of financing the investment using one of the following owner occupied multi family loans.

Originating mortgages secured by these types of properties through freddie mac mortgage products makes it possible to serve a greater number of borrowers with diverse financial circumstances and increase your community reinvestment act cra eligible originations.

Freddie mac requires a 15 down payment on two unit owner occupant home purchases.

Financing an owner occupied multi family investment.